Step-by-Step Guide to Remortgaging Your UK Home

Step-by-Step Guide to Remortgaging Your UK Home Remortgaging your home is one of the most effective ways to save money on your mortgage, reduce monthly payments, or release cash for other needs. Yet many UK homeowners delay or avoid remortgaging because they believe it is complicated or risky.

In reality, when done correctly, remortgaging can save thousands of pounds over the life of your loan. This step-by-step guide explains how remortgaging works in the UK, when it makes sense, the full process involved, and how to maximise savings in 2025.

What Is Remortgaging?

Remortgaging means switching your existing mortgage to:

-

A new deal with your current lender, or

-

A new lender altogether

You are not moving home—only changing the mortgage product.

Most people remortgage to:

-

Get a lower interest rate

-

Reduce monthly repayments

-

Avoid moving onto a higher standard variable rate (SVR)

-

Release equity from their property

When Should You Remortgage?

Step-by-Step Guide to Remortgaging Your UK Home Timing is crucial. The best time to remortgage is usually 3–6 months before your current deal ends.

Common Reasons to Remortgage

-

Your fixed or tracker deal is ending

-

Interest rates have dropped

-

Your home value has increased

-

Your credit score has improved

-

You want to overpay or release equity

If your mortgage has already moved onto the lender’s SVR, you may be paying hundreds of pounds more per month than necessary.

Step 1: Check Your Current Mortgage Details

Before doing anything, review your existing mortgage:

-

Current interest rate

-

Remaining balance

-

Remaining term

-

Early repayment charges (ERCs)

-

End date of your current deal

Early repayment charges can range from 1%–5% of the outstanding balance, so factor this into your decision.

Step 2: Understand Your Property Value and Equity

Step-by-Step Guide to Remortgaging Your UK Home Your loan-to-value (LTV) ratio plays a major role in the deals available to you.

What Is LTV?

LTV = Mortgage balance ÷ Property value

Example:

-

Property value: £300,000

-

Mortgage balance: £180,000

-

LTV: 60%

Lower LTV = better interest rates.

If your home has increased in value or you’ve paid off a significant portion of the loan, remortgaging can unlock much cheaper deals.

Step 3: Check Your Credit Score

Your credit profile affects:

-

Approval chances

-

Interest rate offered

Before remortgaging:

-

Pay bills on time

-

Reduce outstanding debts

-

Avoid new credit applications

-

Check your credit report for errors

Even small improvements can make a difference.

Step 4: Decide What You Want From Remortgaging

Step-by-Step Guide to Remortgaging Your UK Home Be clear about your goals. Are you looking to:

-

Lower monthly payments?

-

Reduce overall interest paid?

-

Fix your rate for longer?

-

Release equity for renovations or debt consolidation?

Your objective will determine the best mortgage type.

Step 5: Compare Remortgage Deals

You can compare deals:

-

Directly with lenders

-

Through comparison websites

-

Via a mortgage broker

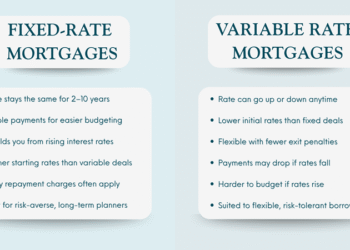

Types of Remortgage Deals

Fixed-Rate Remortgage

-

Stable monthly payments

-

Popular in uncertain markets

Tracker or Variable Remortgage

-

Payments can rise or fall

-

More flexibility

Offset Mortgages

-

Link savings to reduce interest

-

Suitable for higher earners with savings

Always compare:

-

Interest rate

-

Fees

-

Overall cost over the deal period

Step 6: Decide Whether to Use a Mortgage Broker

A mortgage broker can:

-

Access exclusive remortgage deals

-

Compare the whole market

-

Handle paperwork

-

Save time and money

Many UK brokers offer free advice and are paid by lenders, making them cost-effective for most homeowners.

Step 7: Apply for the Remortgage

Step-by-Step Guide to Remortgaging Your UK Home Once you choose a deal, the application process begins.

You will usually need:

-

Proof of income (payslips or accounts)

-

Bank statements

-

ID and address verification

-

Mortgage details

The lender will assess affordability and creditworthiness.

Step 8: Property Valuation

Step-by-Step Guide to Remortgaging Your UK Home The new lender will arrange a valuation to confirm the property’s value.

Valuations may be:

-

Desktop (online estimate)

-

Drive-by

-

Full physical valuation

Many remortgage deals include free valuations.

Step 9: Legal Work and Conveyancing

Remortgaging involves legal work, even though you are not moving.

The solicitor will:

-

Repay your old mortgage

-

Register the new lender

-

Handle legal checks

Many lenders offer free legal services for remortgaging, reducing upfront costs.

Step 10: Completion and Switching

On completion day:

-

Your old mortgage is paid off

-

Your new mortgage starts

-

Monthly payments change

There is no break in ownership, and the process is usually seamless.

How Remortgaging Saves You Money

1. Lower Interest Rates

Step-by-Step Guide to Remortgaging Your UK Home Switching from an SVR to a fixed or tracker rate can save £100–£400 per month.

2. Reduced Overall Interest

A better rate means less interest paid over time.

3. Improved Cash Flow

Lower payments free up money for savings or investments.

4. Avoiding SVR Traps

SVRs are usually much higher than competitive deals.

Example: How Much Can You Save?

Mortgage balance: £180,000

Old SVR: 6.5%

New fixed rate: 4.5%

Monthly saving: ~£200

Annual saving: ~£2,400

Over a 5-year fixed deal, that’s £12,000 saved.

Common Remortgaging Mistakes to Avoid

-

Waiting too long and falling onto SVR

-

Ignoring fees and overall cost

-

Not checking ERCs

-

Focusing only on monthly payments

-

Not seeking professional advice

Can You Remortgage With Bad Credit?

Step-by-Step Guide to Remortgaging Your UK Home Yes, but:

-

Options may be limited

-

Rates may be higher

-

Specialist lenders may be required

Improving your credit score before remortgaging can significantly improve outcomes.

Can You Release Equity When Remortgaging?

Yes. Many homeowners remortgage to:

-

Fund home improvements

-

Consolidate debts

-

Support family members

Be cautious—this increases borrowing and long-term interest.

Remortgaging in 2025: Market Outlook

In 2025:

-

Interest rates remain competitive but cautious

-

Lenders reward lower LTV borrowers

-

Fixed-rate remortgages are popular

-

Early planning is essential

Homeowners who act early have the most choice and bargaining power.

Final Thoughts: Is Remortgaging Worth It?

Step-by-Step Guide to Remortgaging Your UK Home For most UK homeowners, yes.

Remortgaging is one of the simplest ways to:

✔ Reduce monthly costs

✔ Gain financial stability

✔ Adapt your mortgage to your life changes

The key is planning ahead, comparing deals, and understanding the full costs.

READ ALSO :