First-Time Buyer Mortgage Guide UK: Schemes & Deposits

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Buying your first home is one of the biggest financial decisions you’ll ever make. For many people in the UK, the process can feel confusing—mortgages, deposits, credit checks, government schemes, and legal steps all come at once. This guide explains everything a first-time buyer needs to know about UK mortgages, including available schemes, deposit requirements, eligibility, and the step-by-step process to get your keys.

Whether you’re just starting to save or ready to apply, this guide will help you move forward with confidence.

Who Is a First-Time Buyer in the UK?

In the UK, you’re usually classed as a first-time buyer if:

-

You have never owned a property anywhere in the world

-

You are buying your main residential home

-

You are not named on another mortgage

First-time buyer status is important because it gives you access to special mortgage rates, government schemes, and stamp duty relief.

How Do First-Time Buyer Mortgages Work?

First-Time Buyer Mortgage Guide UK: Schemes & Deposits A mortgage is a loan used to buy a property, repaid monthly over a long period (usually 25–40 years). As a first-time buyer, lenders assess:

-

Your income and employment status

-

Your credit history

-

Your deposit size

-

Your monthly expenses and debts

If approved, the lender pays most of the property price, and you repay it with interest.

Deposit Requirements for First-Time Buyers

Minimum Deposit

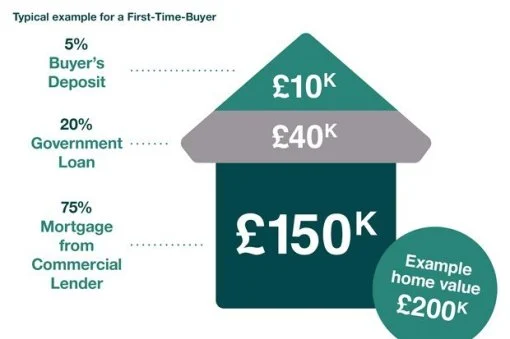

Most UK lenders require a minimum deposit of 5% of the property value. For example:

-

£200,000 home → £10,000 deposit (5%)

However, a larger deposit gives you access to better interest rates.

Common Deposit Levels

-

5% deposit – Limited lenders, higher interest

-

10% deposit – More choice, better rates

-

15–20% deposit – Much lower interest, easier approval

Saving for a deposit is often the hardest part, which is why government schemes exist to help.

UK Government Schemes for First-Time Buyers

1. Lifetime ISA (LISA)

The Lifetime ISA is one of the best tools for first-time buyers.

How it works:

-

You can save up to £4,000 per year

-

The government adds a 25% bonus

-

Maximum bonus: £1,000 per year

Rules:

-

You must be aged 18–39 to open one

-

The property price must be within the scheme limit

-

The money must be used for your first home

This is ideal if you’re planning ahead and saving gradually.

2. Shared Ownership

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Shared Ownership allows you to buy a portion of a property (usually 25%–75%) and rent the rest.

Benefits:

-

Lower deposit required

-

Smaller mortgage

-

Option to buy more shares later (“staircasing”)

Things to consider:

-

Rent is still payable

-

Service charges may apply

-

Selling can be more complex

This scheme is popular with buyers who struggle to afford full ownership.

3. Mortgage Guarantee Scheme

This scheme helps buyers with small deposits (5%) by encouraging lenders to offer more low-deposit mortgages.

Key points:

-

Available through participating lenders

-

Suitable for first-time buyers and home movers

-

Applies to residential properties

It doesn’t give you money directly, but it increases mortgage availability.

4. Stamp Duty Relief for First-Time Buyers

First-Time Buyer Mortgage Guide UK: Schemes & Deposits First-time buyers in England and Northern Ireland may pay reduced or zero stamp duty up to certain property price thresholds.

This can save you thousands of pounds upfront, making buying more affordable.

Types of Mortgages for First-Time Buyers

Fixed-Rate Mortgage

-

Interest rate stays the same for a set period (2–5 years)

-

Predictable monthly payments

-

Popular with first-time buyers

Variable-Rate Mortgage

-

Interest can go up or down

-

Includes tracker and standard variable rates

-

Less predictable but sometimes cheaper initially

Longer-Term Mortgages

-

30–40 year terms reduce monthly payments

-

More interest paid overall

-

Useful if affordability is tight

How Much Can You Borrow?

Most lenders offer 4 to 4.5 times your annual income, depending on:

-

Job stability

-

Credit score

-

Existing debts

-

Household income (joint applications)

Example:

-

£35,000 salary → £140,000–£157,500 mortgage (approx.)

Use online mortgage calculators for estimates, but always speak to a broker for accuracy.

Step-by-Step: How to Buy Your First Home in the UK

Step 1: Check Your Credit Score

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Your credit history affects:

-

Mortgage approval

-

Interest rate offered

Pay bills on time, reduce debts, and avoid new credit before applying.

Step 2: Save for Deposit and Fees

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Besides your deposit, budget for:

-

Solicitor fees

-

Survey costs

-

Mortgage fees

-

Moving expenses

Step 3: Get a Mortgage in Principle (MIP)

A Mortgage in Principle shows:

-

How much you can borrow

-

That a lender is likely to approve you

This makes you more attractive to sellers.

Step 4: Find a Property

Work with estate agents and search online portals. Make offers within your budget.

Step 5: Apply for the Mortgage

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Submit documents such as:

-

ID and address proof

-

Payslips and bank statements

-

Employment details

The lender will arrange a property valuation.

Step 6: Legal Work and Surveys

Your solicitor handles contracts, searches, and legal checks. A survey checks the property’s condition.

Step 7: Exchange Contracts and Complete

Once contracts are exchanged:

-

The deal is legally binding

-

You pay your deposit

On completion day, you receive the keys—congratulations, you’re a homeowner!

Common Mistakes First-Time Buyers Make

-

Borrowing the maximum without budgeting

-

Ignoring additional costs

-

Not using a mortgage broker

-

Skipping surveys to save money

Avoiding these mistakes can save stress and money.

Should You Use a Mortgage Broker?

First-Time Buyer Mortgage Guide UK: Schemes & Deposits A mortgage broker can:

-

Access deals not available directly

-

Explain complex terms clearly

-

Improve approval chances

Many brokers offer free advice, especially for first-time buyers.

Final Thoughts

First-Time Buyer Mortgage Guide UK: Schemes & Deposits Buying your first home in the UK can feel overwhelming, but with the right knowledge, it becomes manageable. Understanding mortgages, deposits, and first-time buyer schemes puts you in control of the process.

Start early, plan carefully, and use the support available to you. Your first home may be closer than you think.

READ ALSO :

Fixed Vs Variable Rate Mortgages In The UK: Which Is Better In 2025?