The State Theory of Money by Georg Friedrich Knapp

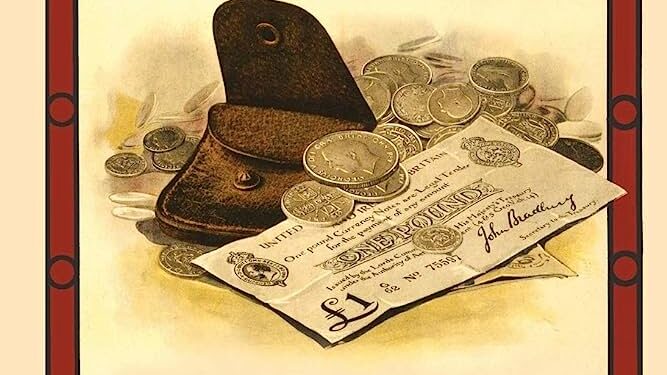

“The State Theory of Money” by Georg Friedrich Knapp is a seminal work that revolutionized our understanding of the nature and origins of money. Originally published in 1905, Knapp’s book presents a groundbreaking theory that challenges traditional views on the role of governments in the creation and regulation of money. Drawing on historical evidence and economic analysis, Knapp argues that money is not based on commodity value but is instead a social construct, created and sustained by the authority and acceptance of the state. This book review explores the key concepts and contributions of “The State Theory of Money” and highlights its enduring relevance in modern economics.

Synopsis and Content Overview:

“The State Theory of Money” explores the fundamental nature of money and its relationship to the state. Knapp rejects the idea that money arises from barter or has intrinsic value. The State Theory of Money by Georg Friedrich Knapp Instead, he proposes that money is a token of the state’s authority, functioning as a medium of exchange, unit of account, and store of value due to the government’s power to enforce its use.

The book begins by tracing the historical development of money, emphasizing the role of sovereign power in creating and regulating currency. Knapp argues that money’s acceptance relies on the state’s ability to enforce its legal tender laws and the public’s trust in the government’s ability to maintain its value.

Also Read-

- Where The Sun Never Sets by Stuti Changle

- The Book of Life by Robert Collier

- A Motherly Icon by Ravi Shankar Neogi

Knapp introduces the concept of “chartalism,” which asserts that the value of money derives from the state’s declaration of its acceptability for tax payments. The State Theory of Money by Georg Friedrich Knapp According to Knapp, taxes create a demand for the state-issued currency, giving it its value and making it the primary means of exchange within a given jurisdiction.

Furthermore, Knapp discusses the importance of the state’s control over the supply of money and its ability to manage economic stability. The State Theory of Money by Georg Friedrich Knapp He explores the relationship between money, credit, and inflation, highlighting the state’s role in balancing these factors through fiscal and monetary policy.

Review and Analysis:

“The State Theory of Money” is a groundbreaking work that challenges traditional economic theories on the nature of money. Knapp’s central thesis, that money is a social institution backed by the authority of the state, has had a profound impact on the field of monetary theory.

One of the book’s strengths is its historical analysis of the development of money. Knapp convincingly argues that money emerges as a result of state power rather than as a spontaneous outcome of market transactions. The State Theory of Money by Georg Friedrich Knapp By examining various historical examples, such as ancient civilizations and medieval monetary systems, Knapp demonstrates how money has always been intimately tied to political authority.

Knapp’s concept of chartalism provides a unique perspective on the value of money. The State Theory of Money by Georg Friedrich Knapp He argues that the government’s ability to enforce the use of its currency for tax payments creates a demand for that currency, giving it value and acceptance. The State Theory of Money by Georg Friedrich Knapp This insight challenges the prevailing view that money derives its value solely from its intrinsic properties or its connection to a valuable commodity.

Moreover, Knapp’s analysis of the state’s role in managing money supply and economic stability is particularly relevant in today’s context. The State Theory of Money by Georg Friedrich Knapp He highlights the importance of the state’s ability to regulate credit and control inflation, emphasizing the need for responsible fiscal and monetary policies to maintain a stable currency and promote economic well-being.

Critics of “The State Theory of Money” argue that it oversimplifies the complex interactions of money in the economy and overlooks market forces and individual preferences. Some contend that the theory does not adequately address the impact of technological advancements, financial innovations, and global economic integration on the functioning of money. The State Theory of Money by Georg Friedrich Knapp Despite these criticisms, the book’s contributions to monetary theory remain significant, and its ideas have influenced subsequent scholars and policymakers.

Conclusion

“The State Theory of Money” by Georg Friedrich Knapp is a groundbreaking work that challenges traditional economic theories and offers a fresh perspective on the nature and origins of money. Knapp’s emphasis on the state’s authority as the foundation of money’s value, his rejection of the barter theory, and his analysis of fiat money have had a significant impact on the field of monetary economics.

The book highlights the role of taxes in creating demand for a specific currency and explores the relationship between the state and central banking institutions. The State Theory of Money by Georg Friedrich Knapp While the book has received criticisms for oversimplification and overlooking market forces, its contributions to monetary theory remain substantial. “The State Theory of Money” continues to be a valuable resource for understanding the complexities of modern monetary systems and their implications for economic stability.

FAQ.

Q1: Who is the author of “The State Theory of Money”?

A: “The State Theory of Money” is authored by Georg Friedrich Knapp.

Q2: What is the main premise of the book?

A: The book argues that money is a social institution created by the state, and its value is derived from the state’s authority and legal acceptance.

Q3: How does the book challenge traditional economic theories?

A: The book challenges the barter theory of money’s origin and emphasizes the importance of the state’s power to impose taxes in establishing the value of money.

Q4: What is the significance of the book in modern economics?

A: The book has had a significant impact on the field of monetary economics, offering insights into the role of the state, the nature of fiat money, and the importance of central banking.

Q5: Has the book received any criticisms?

A: Some critics argue that the book oversimplifies economic interactions and overlooks market forces. However, its contributions to monetary theory remain influential.