Fixed vs Variable Rate Mortgages UK: Which Is Better 2026

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 Choosing the right mortgage is one of the most important financial decisions for homeowners in the UK. With interest rates, inflation, and economic uncertainty constantly changing, deciding between a fixed-rate and a variable-rate mortgage can be confusing.

What Are Fixed and Variable Rate Mortgages?

Fixed-Rate Mortgages

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 A fixed-rate mortgage means your interest rate stays the same for a set period (usually 2–10 years). This ensures that your monthly repayments remain consistent during the fixed period.

Example:

-

Property price: £250,000

-

Mortgage: £200,000

-

Fixed interest: 5% for 5 years

-

Monthly repayment remains the same, regardless of Bank of England rate changes

Variable-Rate Mortgages

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 A variable-rate mortgage means your interest rate can change, usually in line with the Bank of England base rate or the lender’s standard variable rate (SVR).

Types of variable-rate mortgages:

-

Tracker Mortgages: Follow the Bank of England base rate (+ a set margin)

-

Discount Mortgages: Offer a discount on the lender’s SVR for a period

-

Standard Variable Rate (SVR): Lender’s default rate after fixed/discount periods

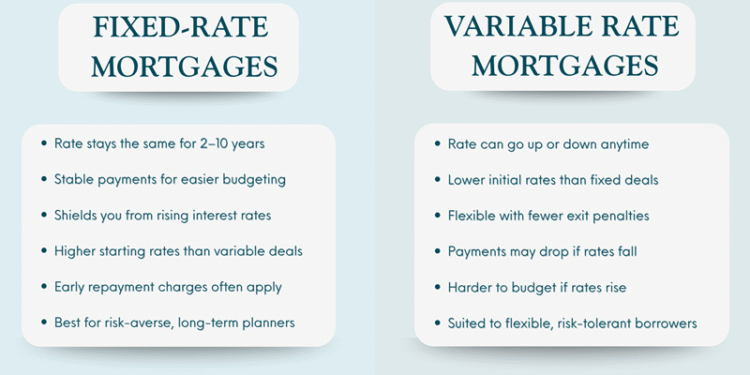

Pros and Cons of Fixed-Rate Mortgages

Pros:

-

Predictable monthly payments – great for budgeting

-

Protection against interest rate rises

-

Stability for long-term planning

Cons:

-

Typically higher interest rates than variable mortgages initially

-

Less flexible – early repayment may incur high charges

-

Can be more expensive if interest rates fall

Pros and Cons of Variable-Rate Mortgages

Pros:

-

Usually lower initial rates than fixed mortgages

-

Can save money if interest rates fall

-

Flexible repayment options in some cases

Cons:

-

Monthly payments can rise suddenly if interest rates increase

-

Harder to budget long-term

-

Some tracker mortgages may have higher margins, reducing savings

UK Mortgage Market in 2026

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 In 2026, the UK mortgage landscape is shaped by:

-

Bank of England base rate: Currently [insert current rate; can update]

-

Inflation and cost of living pressures

-

Housing market growth slowing after recent spikes

Implications:

-

Fixed-rate mortgages may offer more security in a rising interest environment

-

Variable rates could be attractive if base rates fall or remain stable

Who Should Choose a Fixed-Rate Mortgage?

Fixed rates are ideal for homeowners who:

-

Prefer predictable monthly payments

-

Want protection against future interest rate rises

-

Are planning to stay in the property long-term

Example:

If you have a family and need financial stability for budgeting, locking in a fixed rate can prevent unexpected repayment shocks.

Who Should Choose a Variable-Rate Mortgage?

Variable rates may suit those who:

-

Can tolerate some monthly fluctuation

-

Are short-term homeowners planning to remortgage or sell

-

Believe interest rates may fall in the coming years

Example:

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 If you plan to move in 2–3 years, a tracker or discount mortgage could save money compared to locking in a fixed rate now.

Fixed vs Variable Mortgage Costs in 2026

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Interest Rate | Higher, stable | Lower, can fluctuate |

| Monthly Payment | Predictable | Varies |

| Budgeting | Easy | Harder |

| Early Repayment Fees | Often high | Sometimes lower |

| Best for | Long-term, risk-averse | Short-term, flexible |

Tips for Choosing the Right Mortgage in 2026

-

Assess your risk tolerance: Can you handle monthly increases?

-

Consider your plans: How long will you stay in the home?

-

Compare deals: Use mortgage comparison sites or a broker.

-

Factor in fees: Arrangement fees, valuation costs, and exit penalties matter.

-

Think long-term costs: A slightly higher fixed rate may be safer than unpredictable payments.

FAQs:

1. Can I switch from a fixed to a variable mortgage?

Yes, but there may be early repayment charges. Check your lender’s terms.

2. Are fixed mortgages always more expensive than variable ones?

Not always. Depending on market conditions, some fixed deals can be competitive.

3. Is a tracker mortgage safer than an SVR mortgage?

Yes, tracker mortgages follow the Bank of England rate, while SVR is set by the lender and can rise unexpectedly.

4. How long should I fix my mortgage rate?

Common terms are 2, 5, or 10 years. Longer fixes offer stability but may have higher rates.

5. Should I use a mortgage broker?

Yes, brokers can access deals not available directly and advise on market trends.

Conclusion

Fixed vs Variable Rate Mortgages UK: Which Is Better 2026 , choosing between a fixed and variable mortgage depends on your risk tolerance, financial stability, and property plans.

-

Fixed-rate mortgages offer security, predictable payments, and protection from rising interest rates.

-

Variable-rate mortgages offer flexibility and potential savings if rates fall, but monthly payments may fluctuate.

For most long-term homeowners in an uncertain interest rate environment, a fixed-rate mortgage is often the safer choice. Short-term buyers or those comfortable with risk may benefit from variable or tracker mortgages.

READ ALSO :