First-Time Buyer Mortgage UK: Schemes, Deposits & Steps

First-Time Buyer Mortgage UK: Schemes, Deposits & Steps Buying your first home in the UK is an exciting milestone—but it can also feel confusing and overwhelming. From saving a deposit to choosing the right mortgage and understanding government schemes, there’s a lot to get your head around.

This first-time buyer mortgage guide for the UK explains everything you need to know: available schemes, how much deposit you need, and the step-by-step process to buying your first home with confidence.

Who Is a First-Time Buyer in the UK?

In the UK, you are classed as a first-time buyer if:

-

You have never owned a property before (in the UK or abroad)

-

You are buying your first residential home

-

You are not inheriting a property

If you are buying with a partner, both buyers must be first-time buyers to access most schemes and stamp duty relief.

How Much Deposit Do First-Time Buyers Need?

Minimum Deposit

First-Time Buyer Mortgage UK: Schemes, Deposits & Steps Most UK lenders require at least:

-

5% deposit (95% mortgage)

-

Some lenders prefer 10% or more for better rates

Example

-

Property price: £250,000

-

5% deposit: £12,500

-

Mortgage needed: £237,500

Why a Bigger Deposit Helps

-

Lower interest rates

-

Lower monthly repayments

-

More mortgage choices

-

Higher chance of approval

Government Schemes for First-Time Buyers

The UK government offers several schemes to help first-time buyers get onto the property ladder.

1. First Homes Scheme

The First Homes Scheme offers homes at a 30% to 50% discount for local first-time buyers and key workers.

Key points:

-

Discount stays with the property for future buyers

-

Income caps may apply

-

Must be your main residence

Best for buyers struggling with affordability in high-price areas.

2. Shared Ownership

First-Time Buyer Mortgage UK: Schemes, Deposits & Steps With Shared Ownership, you buy a share of a property (usually 25%–75%) and pay rent on the rest.

Pros:

-

Lower deposit required

-

Smaller mortgage

-

Can increase ownership later (“staircasing”)

Cons:

-

Rent increases over time

-

Service charges apply

-

Selling can be more complex

3. Lifetime ISA (LISA)

A Lifetime ISA helps you save for a deposit with a 25% government bonus.

How it works:

-

Save up to £4,000 per year

-

Government adds up to £1,000 annually

-

Use for first home up to £450,000

A LISA is one of the best ways for first-time buyers to boost their deposit.

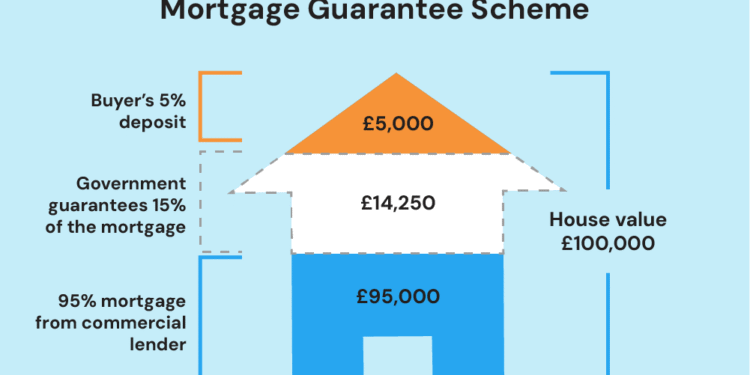

4. Mortgage Guarantee Scheme

This scheme encourages lenders to offer 95% mortgages by guaranteeing part of the loan.

Benefits:

-

Only 5% deposit needed

-

Available on new and existing homes

-

Fixed-rate options available

Types of Mortgages for First-Time Buyers

Fixed-Rate Mortgage

-

Interest rate stays the same for 2–5 years

-

Predictable monthly payments

-

Most popular choice

Variable-Rate Mortgage

-

Rate can go up or down

-

Usually cheaper initially

-

Higher risk if rates rise

Tracker Mortgage

-

Follows the Bank of England base rate

-

Transparent pricing

-

Payments can change monthly

Step-by-Step First-Time Buyer Mortgage Process

Step 1: Check Your Credit Score

-

Register on the electoral roll

-

Pay bills on time

-

Avoid unnecessary credit applications

A strong credit history improves mortgage approval chances.

Step 2: Work Out Your Budget

First-Time Buyer Mortgage UK: Schemes, Deposits & Steps Most lenders allow borrowing 4 to 4.5 times your income.

Example:

-

Annual income: £40,000

-

Mortgage range: £160,000–£180,000

Step 3: Get a Mortgage Agreement in Principle (AIP)

An AIP shows:

-

How much you can borrow

-

That a lender is likely to approve you

Estate agents usually require this before accepting an offer.

Step 4: Choose the Right Mortgage

Compare:

-

Interest rates

-

Fees

-

Early repayment charges

-

Length of fixed term

Using a mortgage broker can help you find better deals.

Step 5: Find a Property & Make an Offer

Once your offer is accepted:

-

Pay the reservation fee (if applicable)

-

Instruct a solicitor or conveyancer

Step 6: Apply for the Mortgage

You’ll need:

-

Proof of income

-

Bank statements

-

ID documents

The lender will arrange a property valuation.

Step 7: Exchange Contracts

-

Pay your deposit

-

Contracts become legally binding

Step 8: Completion

-

Mortgage funds are released

-

You get the keys

-

You officially own your first home 🎉

Extra Costs First-Time Buyers Should Budget For

-

Solicitor and conveyancing fees

-

Mortgage arrangement fees

-

Survey costs

-

Moving expenses

-

Stamp Duty (often reduced or zero for first-time buyers)

Common First-Time Buyer Mistakes to Avoid

❌ Not checking total monthly costs

❌ Forgetting additional fees

❌ Overstretching your budget

❌ Ignoring future interest rate rises

❌ Not comparing mortgage deals

FAQs:

1. Can I get a mortgage with a 5% deposit?

Yes. Many lenders offer 95% mortgages, especially through the Mortgage Guarantee Scheme.

2. What credit score do I need?

There’s no fixed score, but good credit history increases approval chances.

3. Are first-time buyers exempt from stamp duty?

Often yes, depending on property value. Relief thresholds apply.

4. Can I buy with someone who isn’t a first-time buyer?

Yes, but you may lose access to some schemes and tax relief.

5. Is it better to use a mortgage broker?

For many first-time buyers, yes. Brokers can access deals not available directly.

Conclusion

First-Time Buyer Mortgage UK: Schemes, Deposits & Steps Getting your first-time buyer mortgage in the UK doesn’t have to be stressful. By understanding government schemes, saving the right deposit, and following a clear step-by-step process, you can move onto the property ladder with confidence.

Take time to compare mortgage options, use available support schemes, and plan your budget carefully. The right preparation today can save you thousands over the life of your mortgage—and make your first home purchase a positive, rewarding experience.

READ ALSO :